This analysis provides a comparison of Ohio’s foundation funding formula in FY24 and FY25. Data for this analysis is from Ohio Department of Education and Workforce’s (ODEW) FY24 Final #2 school finance payment report (SFPR) and the FY25 August #2 SFPR. Note that FY25 funding levels are currently based on FY24 enrollment data. This analysis will be updated in November when current year enrollment data for FY25 is available. The primary conclusion of this analysis is that by updating only the property valuation and income data used in the calculation of the state/local share and not the input data used to compute the base cost amount, the state has significantly lowered the state share of funding in FY25 and essentially implemented the 4th year of the phase-in of the Fair School Funding Plan at virtually zero cost to itself and minimal benefit of increased in funding to Ohio’s 609 school districts.

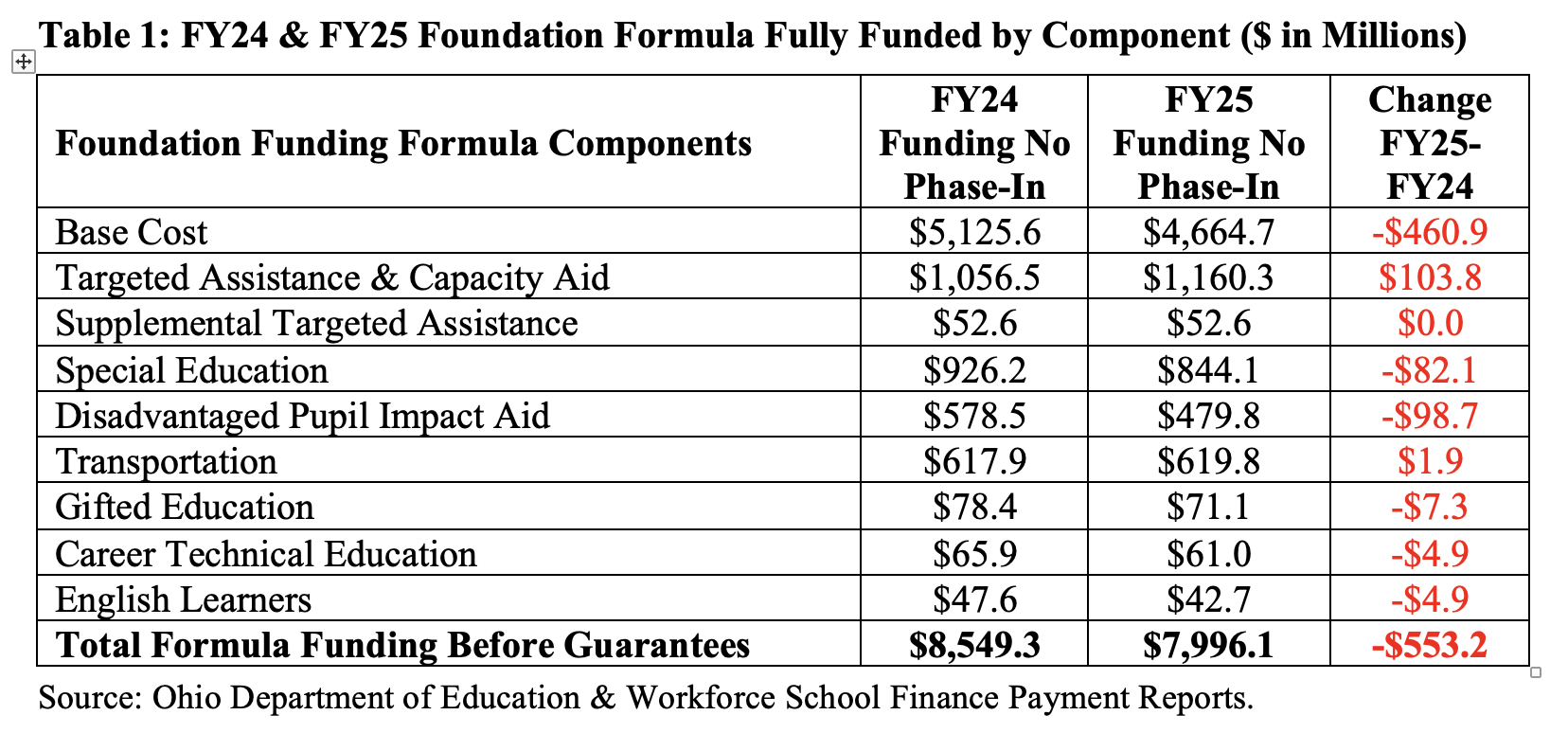

Table 1 provides a comparison of FY24 and FY25 funding for each component of the state’s foundation formula with the exception of the Transitional Aid Guarantee and the Formula Transition Supplement. In Table 1 all figures reflect the aid amount for each component if the funding formula was fully funded (i.e. no phase-in) in both years.

Table 1 shows that the Fair School Funding Plan would have provided $8.549 billion in funding if fully funded in FY24 and $7.996 billion if fully funded in FY25. (Again, both of these totals are prior to the implementation of the transitional aid guarantee formula transition supplement.) The FY25 fully funded foundation formula total is $553 million less than the FY24 fully funded formula total. The primary reason for the drop in funding in FY25 if the funding formula were fully funded in each year is that the statewide state share of funding has decreased from 43.30% in FY24 to 39.33% in FY25 (these figures both computed by OEPI). The reason for the decrease in the state share is that in FY25 both the property valuation and income data used to compute the state/local share have been updated while the inputs used to determine the base cost amount in each school district have remained unchanged. Replacing Tax Year 2020 property values with the much higher Tax Year 2023 values and the Tax Year 2019 income measures with the higher Tax Year 2022 measures means that the local share of funding increases in virtually all school districts while the state share decreases. The more than half billion dollar decrease in the state’s share of a fully funded formula indicates the need to update all of the data in the formula on the same schedule.

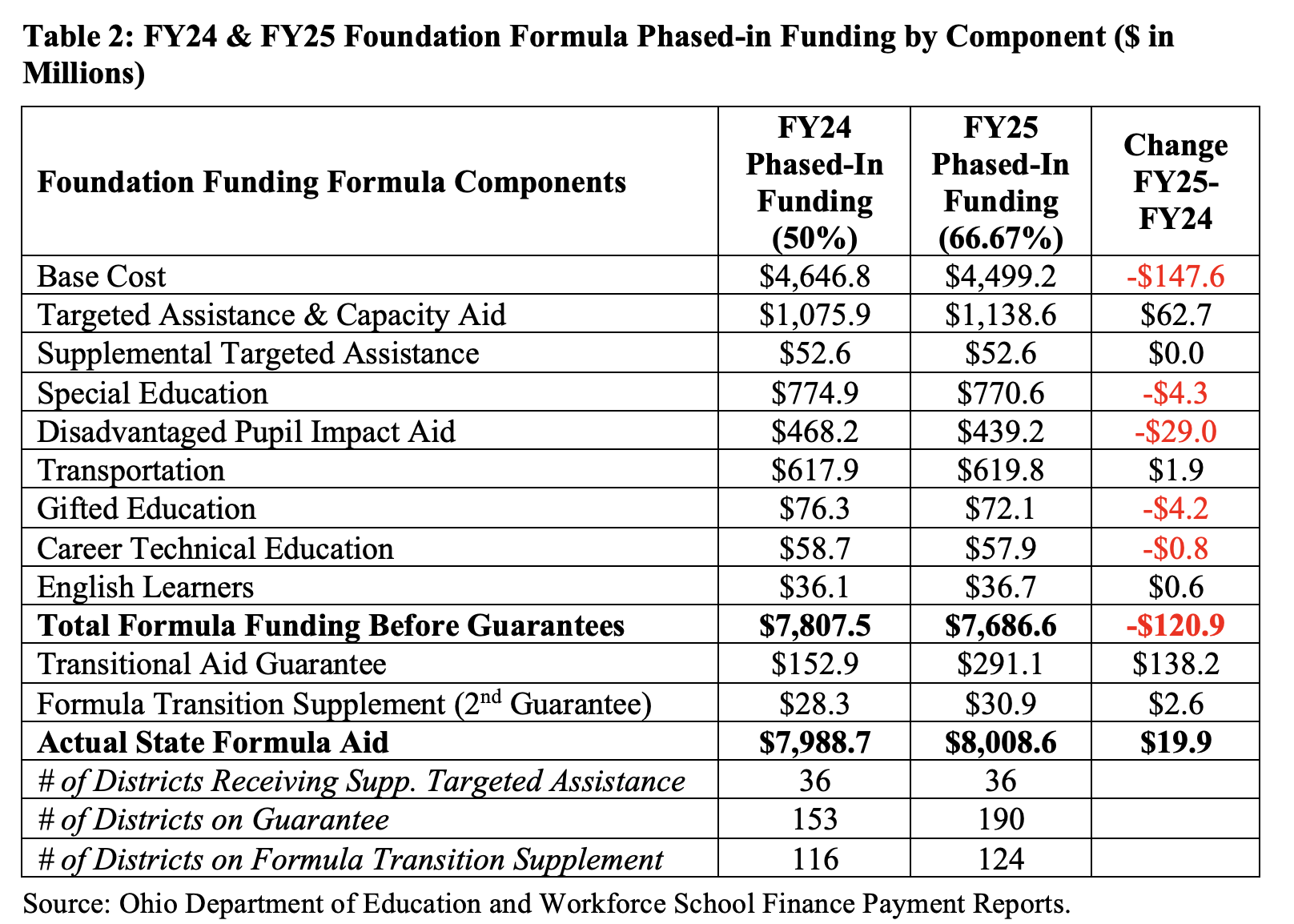

Table 2 provides a second comparison of FY24 and FY25 funding. Table 2 shows actual funding amounts for each component of the state’s foundation formula taking onto the 50% phase-in percentage used in FY24 and the 66.67% phase-in percentage used in FY25. The data shown in Table 2 also include the Transitional Aid Guarantee and the Formula Transition Supplement. Thus, the figures shown in Table 2 reflect the actual aid amount for each component in both years (note that the FY25 figures are preliminary as not all data used in this year’s formula had been updated by ODEW at the time this analysis was conducted).

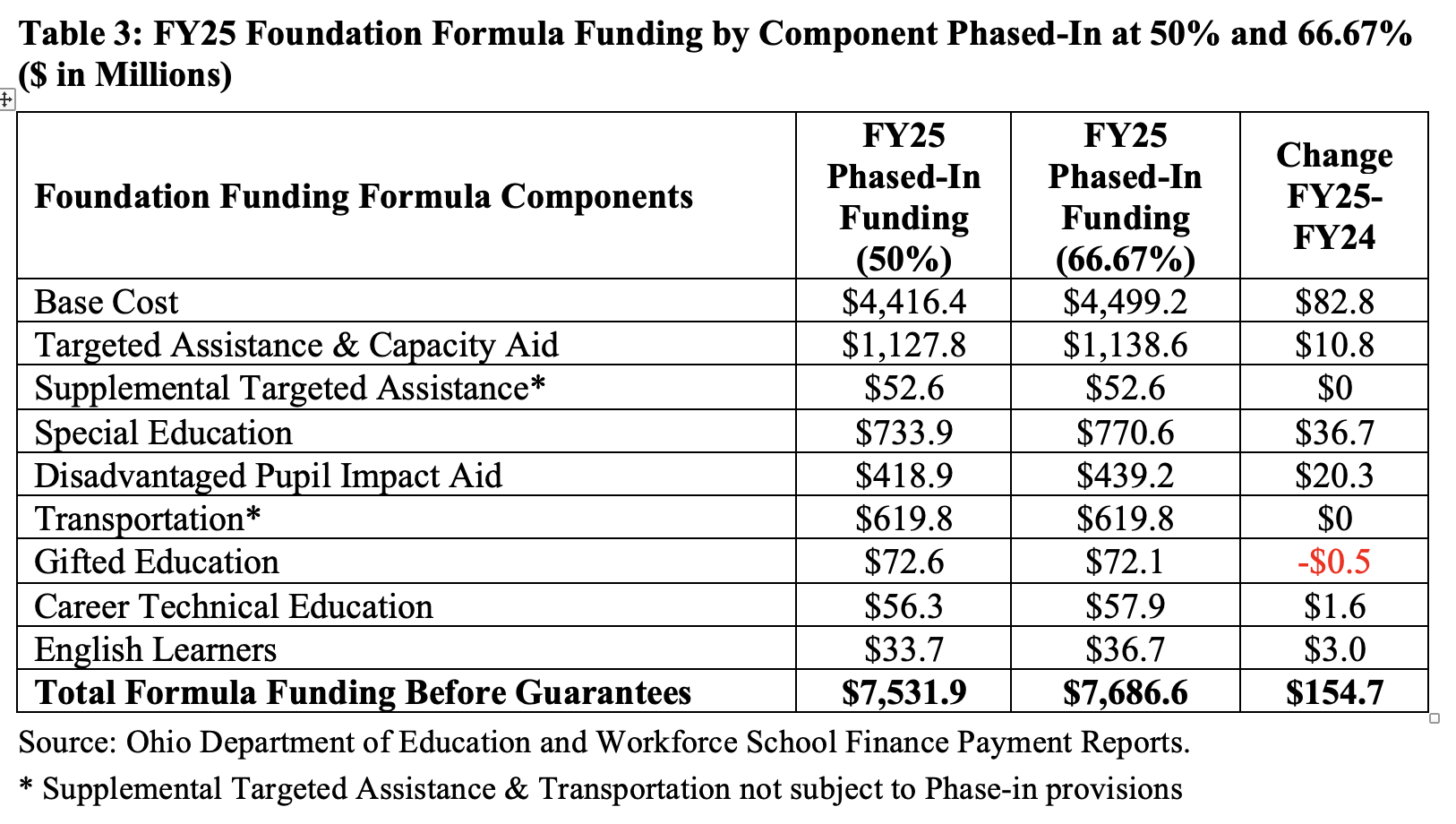

Table 3 provides a third and final comparison of FY24 and FY25 funding, this time isolating the impact of the increase in the phase-in percentage from 50% to 66.67%.

Table 2 shows that even with the increased phase-in percentage in FY25, the decrease in the state share percentage in FY25 means that actual funding in FY25 is currently estimated to be $121 million less than actual FY24 funding prior to the application of the transitional aid guarantee and formula transition supplement. Table 2 then shows that the transitional aid guarantee is estimated to nearly double in FY25 from $152.9 million to $291.1 million. This significant increase in the guarantee is not just the result of more districts being on the guarantee (190 in FY25 vs 153 in FY24) but primarily because the amount of the guarantee increases in FY25 in all but 4 of the 153 districts on the guarantee in FY24. Overall, Table 2 shows that actual funding in FY25 is currently estimated to increase by just $19.9 million (0.25%) over FY24 funding.

Table 3 illustrates the financial impact of increasing the phase-in percentage from 50% in FY24 to 66.7% in FY25, all other things equal. Column 1 of Table 3 shows the level of funding that would be provided in FY25 for each component of the formula if the phase-in percentage remained at 50%, while Column 2 repeats the data shown in Table 2 reflecting the amount for each component using the actual FY25 phase-in percentage of 66.67%.

Table 3 shows that increasing the phase-in percentage results in an increase of nearly $155 million in funding in FY25. Thus, when Tables 1, 2 and 3 are considered together, the reduction in funding caused by the reduced FY25 state share shown in Table 1 effectively offsets the increase in funding caused by the increase in the phase-in percentage shown in Table 3, thereby resulting in only the modest total increase in funding of $19.9 million shown in Table 2. Therefore, by choosing in FY25 to only update the property valuation and income data used in the calculation of the state/local share and not the input in data used to compute the base cost, the state has essentially implemented the 4th year of the Fair School Funding Plan phase-in at virtually zero cost to itself and minimal benefit of increased in funding to Ohio’s 609 school districts.