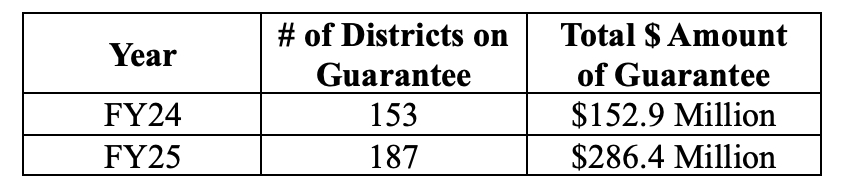

The table below shows that the both the number of districts on the guarantee and the amount of the guarantee increased from FY24 to FY25.

While there have been recent assertions that there is one primary explanation of why school districts are on the guarantee, there are in fact 3 general reasons why a district may be on the guarantee:

- Decrease in enrollment

- Increase in property valuation (and/or the income of district residents under the current formula)

- Issues with the funding formula itself that lead to reductions in state funding from one year to the next

1. Enrollment Decline

Not all school districts on the guarantee have lost enrollment and not all districts losing enrollment are on the guarantee.

- 31 districts of the 187 districts on the guarantee in FY25 experienced an increase in enrollment from FY24 to FY25.

- Similarly, 176 districts either went on the guarantee in FY25 or saw their guarantee amount increase in FY25. 29 of these districts experienced enrollment growth in FY25.

- Looked at another way, 464 school districts lost enrollment from FY24 to FY25. Only 155 (33.4%, almost exactly 1/3) of these were on the guarantee in FY25. This means that 2/3 of districts that lost enrollment were not on the guarantee in FY25.

- A final perspective is that 17 school districts on the guarantee in FY24 either went off the guarantee entirely or saw their guarantee amount decrease. 15 of these 17 districts lost enrollment in FY25. This is counter to the premise that enrollment decline increases the guarantee.

2. Property Reappraisal and Valuation Increase

Tax Year 2023 saw a statewide average increase in the reappraisal value of Class 1 (residential & agricultural) properties of 34.7%. This is by far the largest reappraisal increase this century. This increase in valuation is important because 2023 property values replaced 2020 values in the 3-year average used in the computation of the state and local share of school funding in FY25.

- Of the 41 districts that were not on the guarantee in FY24 and went on the guarantee in FY25, 26 underwent property reappraisal or the statistical reappraisal update in 2023.

- Overall, 86 of the 176 districts with an FY25 guarantee amount larger than their FY24 guarantee amount underwent property reappraisal or the statistical reappraisal update in 2023.

3. Issues with the Funding Formula

The most significant issue with Ohio’s school funding formula that is impacting the likelihood of being on the guarantee or not is the asymmetry between the updating of the base cost inputs and the updating of the property valuation and district income data that is used in the state/local share calculation.

In FY24 the inputs used to compute the base cost were updated from FY18 to FY22 (because of data availability there is a 2-year lag between the most current inputs and the school year in question). In order for the base cost calculation to remain current the inputs should have been updated to FY23 for use in the FY25 funding formula, however the legislature did not opt to make this update. This resulted in the base cost (as well as other components of the funding formula that use weights applied to the base cost) to remain the same in FY25 as in FY24.

The issue arises because the Ohio Revised Code specifically directs the state to annually update the property value and income data used to compute the state and local share of formula funding. Because higher property values and district income figures cause the local share of funding to increase, the state share of funding necessarily decreases. This caused the statewide average state share of the base cost to drop from 43.3% in FY24 to 39.3% in FY25. When the state share of funding goes down and the adequacy side of the formula is frozen, many districts will receive less state aid, even if the phase-in percentage has been increased. When the state share decreases state aid will decrease, and this can cause districts not on the guarantee to go on the guarantee and districts already on the guarantee to have their guarantee amount increase.

- From FY24 to FY25 542 of the 609 districts (89%) saw their share percentage decrease

- From FY24 to FY25 63 of the 609 districts saw their share percentage remained unchanged. All 63 of these districts have the minimum state share of 10%

- From FY24 to FY25 only 4 of the 609 districts saw their share percentage increase

- Of the 176 districts that had their guarantee amount increase in FY25, 135 had their state share percentage decrease and 40 had their state share percentage remain the same. Only one of these districts had their state share percentage increase from FY24 to FY25.

- All 41 districts that were newly on the guarantee in FY25 had their state share percentage decrease from FY24 to FY25.

- Of the 80 districts whose guarantee amount increased by the largest percentage in FY25, 79 had their state share percentage decrease from FY24 to FY25 (the other district had it remain the same).

It is also important to note that because of the small role played by the school district income tax there is virtually no direct link between district income levels and local tax revenues. And, as a result of HB 920, the extent to which higher property values from reappraisal translate into higher property tax revenues varies widely across school districts. It is for these reasons that that property valuation increases have traditionally been counterweighted by annual updates to the funding formula parameters in Ohio’s school funding formulas.

Ohio’s Declining State Share of K-12 Funding

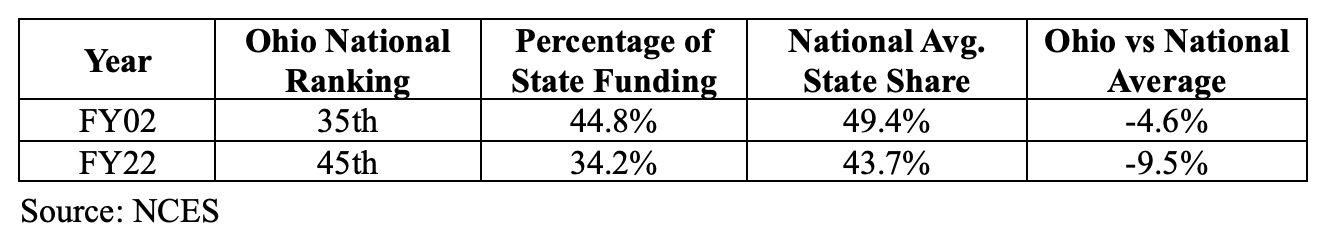

As a final note, data from the National Center for Educational Statistics reveals that Ohio’s share of state funding of K-12 education has fallen from 2002 to 2022 (most current year for which data is available).

The table below shows that in 2002 Ohio contributed 44.8% of K-12 education funding which was 4.6 percentage points below the national average of 49.4%.

However, by 2022, Ohio’s share of K-12 funding had fallen to 34.2%, which was 9.5 percentage points below the 2022 national average of 43.7%.