The Ohio Legislative Service Commission (LSC) released their fiscal analysis of House Bill (HB) 1 earlier this week. This document begins with a summary of the main findings from LSC’s analysis and continues with an explanation of how these findings were determined.

Summary of Main Implications of HB 1

State Income Tax Restructuring

- The conversion of Ohio’s state graduated state income tax to a flat rate 2.75% income tax will reduce state tax revenues by $2.515 billion in FY24, by $1.792 billion in FY25, and by an increasing amount in FY26 and thereafter.

- The flattening of the income tax rate structure benefits the wealthiest persons in Ohio far more than it benefits lower income persons.

Changes to Ohio’s Local Property Tax

- The elimination of the 10% rollback on residential and agricultural property taxes will save the state an estimated $1.309 billion annually.

- In order to attempt to avoid an immediate and automatic annual increase of $1.309 billion in property taxes paid by homeowners and farmers in 2024, HB 1 lowers the assessment percentage on residential and agricultural property from 35% to 31.5%. Because the Ohio constitution specifies that there must be uniformity in property assessment across the state, this also requires that the assessment percentage on business and commercial property also be lowered to 31.5%.

- However, because of various features of Ohio’s property tax, the decrease in the assessment percentage does not effectively insulate residential and agricultural taxpayers from a significant tax increase. According to LSC’s analysis, the following changes will occur as a result of HB 1:

- $538 million annual decrease in local tax revenues for schools and local governments

- $929 million annual tax increase for residential and agricultural property taxpayers

- $157 million annual tax decrease for business and commercial property taxpayers

These findings are explained below.

Part I. Income Tax Restructuring and Rate Cut

HB 1 will convert the state income tax from its current graduate rate structure to a flat tax of 2.75%, effective in 2023.

HB 1 Tax Reductions Favor the Wealthiest Ohioans

The change to a flat tax will reduce the equity of Ohio’s income tax as compared to the current graduated rate structure.

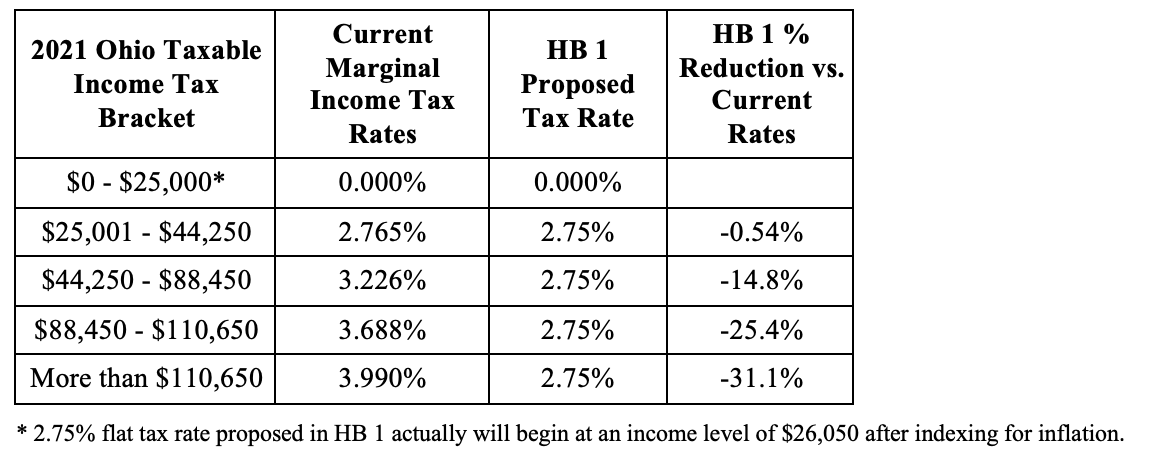

LSC’s analysis indicates that the percentage reduction in the marginal tax rates will range from -0.54% to -31.1%. A complete list of the rate reductions for each tax bracket is shown in the table below:

State Revenue Impact of Income Tax Cut

LSC estimates that HB 1’s changes to the state income tax will cause the state General Revenue Fund (GRF) tax revenue reductions detailed below. Note that the Public Library Fund (PLF) and Local Government Find (LGF) each receive 1.66% of state GRF tax revenues according to Ohio permanent law.

FY24: $1.734 billion reduction + $867 million one-time loss due to changes to Ohio withholding rates 2023 after bill passage = $2.601 billion

LGF & PLF payment reduction = -$86 million

Net FY24 GRF tax revenue reduction = $2.515 billion

FY25: $1.854 billion reduction

LGF & PLF payment reduction = -$62 million

Net FY25 GRF tax revenue reduction = $1.792 billion

FY26 and thereafter: More than $1.8 billion and escalating annually

Part II. Property Tax Changes

HB 1 makes two major changes to Ohio’s property tax. The first is the elimination of the non-business tax credit, commonly known as the 10% rollback. The 10% rollback was created in 1971 at the same time the state income tax was created and means that the state pays 1/10th of property taxes for each residential and agricultural taxpayer. The second change is the reduction in the assessment percentage from 35% to 31.5% on both residential and agricultural real property (also known as “Class 1” property) and business and commercial real property (also known as “Class 2” property). The assessment percentage is the figure that is multiplied by the market value (the value that county auditors place on properties in Ohio) in order to compute the taxable (or “assessed”) value. A house with market value of $200,000 has a taxable value of $70,000 (35% of $200,000).

Step 1: Elimination of the 10% Rollback

LSC estimates that rollback payments made by the state to schools and local governments will total $1.309 billion in tax year 2024. LSC does not provide a 2024 breakdown of rollback payments made to schools vs. other local governments in Ohio, however, tax year 2022 rollback data shows that schools comprised 65.9% of the rollback total and other local governments comprised 34.1%. These percentages suggest that the school share in 2024 of the $1.309 billion rollback total will be roughly $860 million while the local government share will be approximately $450 million. This results in the taxpayer assuming the responsibility for these payments that were previously made by the state. Taxpayers will be paying approximately 65.9% of that increase to schools and 34.1% of the increase to other local governments.

Eliminating the 10% rollback will save the state $1.309 billion annually. Due to the timing of property tax payments LSC states that half of that amount ($650 million) will accrue in FY25 and 100% ($1.3 billion) in savings will accrue to the state in FY26 and thereafter.

If there were no other changes made to the property tax, the elimination of the 10% rollback would mean that residential and agricultural taxpayers would experience a tax increase of $1.309 billion in tax year 2024 and each year thereafter, since they would be assuming responsibility for these payments.

Step 2: Reduction in Assessment Percentage

HB 1 also calls for the reduction of the assessment percentage on residential and agricultural property to be reduced from 35% to 31.5%. This is a 10% reduction in the assessment percentage (3.5 = 10% of 35) and is presumably designed to offset the immediate and automatic increase property taxes that result from of the elimination of the 10% rollback. LSC’s analysis clarifies that HB 1’s reduction in the assessment percentage from 35% to 31.5% will apply to both Class 1 (residential and agricultural) real property and also to Class 2 (business & commercial) real property. This is because the Ohio Constitution requires uniformity in the taxation of all real property across the state.

The reduction in the assessment percentage lowers the taxable value of all real property in Ohio. In the absence of other features of Ohio’s property tax, the reduction in the assessment percentage would reduce residential and agricultural property taxes to roughly the level that they are currently (paying 100% of your taxes on 35% of your home’s current value is roughly equivalent to paying 90% of your taxes on 31.5% of your home’s current value). In addition, schools and local governments would also lose tax revenue because the reduction in the assessment percentage on business and commercial property lowers its taxable value and results in a lower amount of property taxes paid by businesses. However, with the application of HB 920, the lowering of the assessment percentage does not completely operate in this manner. This is discussed in more detail below.

Step 3: Inside Mills, and Fixed Sum Levies

The reality of Ohio’s property tax is not as straightforward as the previous section makes it seem, however. Ohio schools and local governments can receive property tax revenue from three types of levies: 1) unvoted (or “Inside”) millage; 2) voted “fixed rate” levies; and 3) bond and emergency “fixed sum” levies. Each of these types of levies are impacted differently when the assessment percentage is reduced from 35% to 31.5%.

Inside Millage – The Ohio Constitution provides for 10 mills of property tax millage that can be enacted without a vote of the populace in each of the 88 counties. These mills were allocated across schools, counties, municipalities, townships and other local taxing authorities nearly 100 years ago have been rarely changed since then. Schools typically receive 4-5 inside mills. Inside mills always remain the same and when the assessment percentage is reduced to 31.5% local tax revenues from inside millage will be reduced.

Bond and Emergency Levies – Bond and school emergency levies are referred to as “fixed sum” levies because voters approve a dollar amount rather than a millage rate. As a result, the millage rate on these types of levies is adjusted every year as property values change so that the originally voted-upon dollar amount is generated. As a result, when the assessment percentage is reduced to 31.5% tax rates on bond and emergency levies will automatically increase so that the tax revenue collected by these levies remains the same.

Step 4: HB 920

Voted “Fixed Rate” Levies -Operating and permanent levies for schools and local governments are known as “fixed rate” levies and are subject to the provisions of HB 920. HB 920 was implemented in 1976 in the aftermath of rapid increases in home values in the early 1970s. HB 920 creates “tax reduction factors” which reduce the effective rate of voted levies after real property increases in value. The purpose is to ensure that taxes on voted levies do not increase beyond their previous level after property reappraisal. In 1980, HB 920 was enshrined in the Ohio Constitution and real property was split into Class 1 (residential and agricultural property) and Class 2 (business and commercial property). The tax reduction factors are now applied separately to each class of real property.

HB 920 is pertinent to HB 1 because it also works in “reverse.” When property values decrease (as was the case during and after the 2008/2009 recession) the HB 920 tax reduction factors will increase tax rates in order to preserve property tax revenue at the previous level. Thus, when the assessment percentage is reduced from 35% to 31.5%, HB 920 will adjust to increase effective tax rates and increase property taxes to their level when the assessment percentage was 35%.

The one exception to HB 920 increasing tax revenue to the previous level is that tax rates are not allowed to increase beyond their originally voted rate. The LSC memo makes clear that voted levies with an effective tax rate 90% of the voted millage or less will adjust upward to fully offset the reduction in the assessment percentage, while levies within 10% of the original voted rate will not be able to adjust fully and thus result in local tax revenue reductions.

Part III. LSC Estimates of the Impact of HB 1 on Property Taxes

The LSC analysis provides estimates of how the elimination of the 10% rollback and the reduction in the assessment percentage from 35% to 31.5% will impact Ohio’s schools & local governments, as well as residential & agricultural and business & commercial taxpayers. The main findings of the LSC analysis are:

A. Local Property Tax Revenue Loss

- Annual property tax revenue loss from inside millage = -$365 million

- Annual property tax revenue loss on fixed rate levies that cannot adjust upward fully = -$172 million

- Annual total school and local government property tax revenue loss = -$365 million + -$172 million = -$537 million

- The $537 million annual property tax revenue loss is comprised of a -$298 million annual tax loss for schools and a -$239 million tax loss for other local governments

- The $537 million annual property tax revenue loss is derived from -$157 million tax reduction on business and commercial property and a -$380 million tax reduction on residential and agricultural taxpayers

B. Residential and Agricultural Property Tax Increase

- $929 million annual tax increase for residential and agricultural property taxpayers from bond and emergency levies and fixed rate levies which adjust upward$1.309 billion in annual savings to the state by eliminating the rollback on residential and agricultural property is comprised of a $929 million annual tax increase on Ohio homeowners and farmers and the -$380 million residential and agricultural taxpayer share of the -$537million annual tax reduction to Ohio schools and local governments

The bottom line of the LSC analysis is that because of bond and emergency levies guaranteeing a fixed amount of revenue and fixed rate voted levies automatically adjusting upward due to HB 920, HB 1’s attempt to lower the assessment percentage to 31.5% in order to insulate homeowners and farmers from a $1.309 billion tax increase resulting from the elimination of the rollback is not successful.

Instead, residential and agricultural taxpayers will experience a $929 million annual increase in property taxes while schools and local governments will lose $380 million annually in local property taxes. In addition, schools and local governments will lose an additional $157 million annually in local taxes as a result of the decrease in the assessment percentage on business and commercial property. This results in a total annual property tax reduction of $538 million.

Part III. Additional Issues

GDP Deflator Applied to Assessment Percentage in Future Years

HB 1 also calls for the application of a GDP deflator to be applied to the assessment percentage on an annual basis beginning in 2025. LSC’s analysis estimates that the GDP deflator reduction to the assessment percentage in future years will lower the assessment percentage to 27.9% by 2029. The footnote 3 on page 2 of the LSC Fiscal Note indicates that the GDP deflator – accurately described by LSC as a very broad index of nationwide prices, is also used to index state income tax exemption amounts and the homestead exemption income cutoff. While LSC does not say this, the link between the GDP deflator and home values is far more tenuous than the link between the GDP deflator and income levels. This is particularly true because property values vary substantially across the state, and property reappraisal occurs in different years in different counties.

Modification of 2.5% Owner-Occupied Home Rollback

In 2024, HB 1 will replace the current 2.5% owner-occupied home rollback with a flat $125 per taxpayer rollback. LSC’s analysis indicates that the current 2.5% rollback costs the state $226 million in 2021, and they estimate an average rollback amount of $75 per home. Based on this figure, LSC estimates an average increase of $50 per home. Additionally, they project the aggregate cost to the state, caused by enlarging the owner-occupied home rollback, to range from $150 million to $180 million annually. Note that while the average owner-occupied rollback amount will increase under HB 1, homeowners in relatively high cost homes and/or high tax locales will receive a lower credit under HB 1 than they do currently.

Expansion of Homestead Exemption

Ohio’s third and final property tax support program is known as the homestead exemption. The homestead exemption is geared primarily towards individuals 65 years and older and provides them a tax exemption on the first $25,000 of market value of their home. HB 1 proposes indexing the exemption amount for inflation and expanding the exemption amount to $50,000 for individuals who have been in their homes for more than 20 years. LSC tentatively estimates the increased cost to the state of these changes at an additional $28 million per year.