This memo provides an overview of the 142 school levies on the ballot in the upcoming November 5th general election.

According to the Ohio Secretary of State’s November 2024 “Local Issues Report” there are 142 school levies on the ballot on November 5th. (There is also one additional school related issue on the ballot in November – a citizen-led repeal of a 1.25% school district income tax in Northwestern Local school district that has been in place since 1990. This repeal is not included in the levy totals summarized below).

A complete list of local issues on the ballot in November general election can be found on the Ohio Secretary of State’s website at: https://www.sos.state.oh.us/elections/voters/about-this-election/

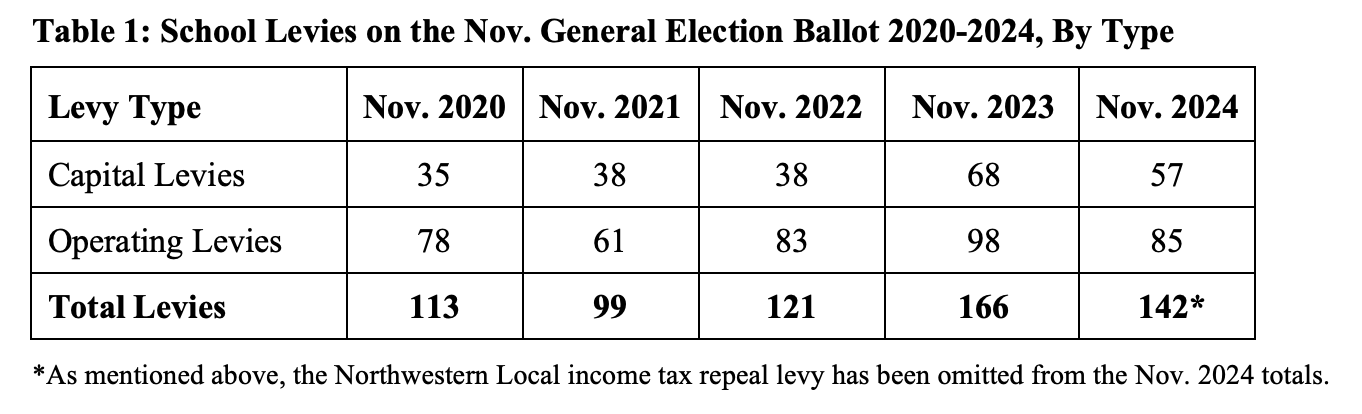

Table 1 provides a summary of the number and type of school levies on the ballot in the November general election over the last 5 years. Table 1 shows that the number of school levies on the November ballot in 2023 and 2024 is significantly higher than the number of levies on the ballot in November 2020, 2021, and 2022. The low number of levies on the ballot from 2020-2022 likely a reflection of school districts’ reluctance to ask voters for levy approval in the aftermath of the COVID pandemic. This appears to particularly be the case for capital levies. The 166 and 141 total levies on the ballot this year and last year is comparable to 2018 and 2019 when 174 and 154 school levies were on the general election ballot. The average number of school levies on the November ballot from 2003-2024 is 173.

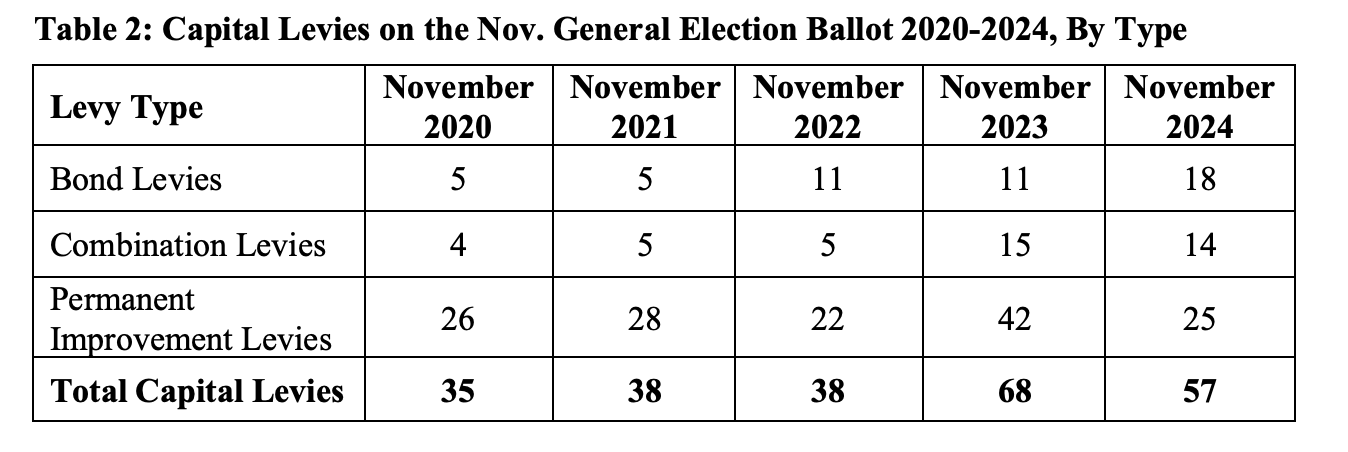

Table 2 provides a more detailed breakdown of capital levies (defined as bond levies, permanent improvement (PI) levies, and combination bond/PI levies) on the ballot in the November general election from 2020-2024. Table 2 shows that the 57 and 68 capital levies on the November ballot the past 2 years is much higher than the totals from 2020-2022. The 2023 and 2024 totals are much more consistent with the 2003-2022 average of 63 capital levies on the general election ballot. The majority of capital levies are typically new levies as Bond and Combination levies are always new as they cannot be renewed. Capital levies overall typically pass 60-65% of the time in Ohio, however the passage rate of new capital levies since 2010 is slightly above 40% while the passage rate for renewal capital levies (all of which are PI renewals) is typically above 90%.

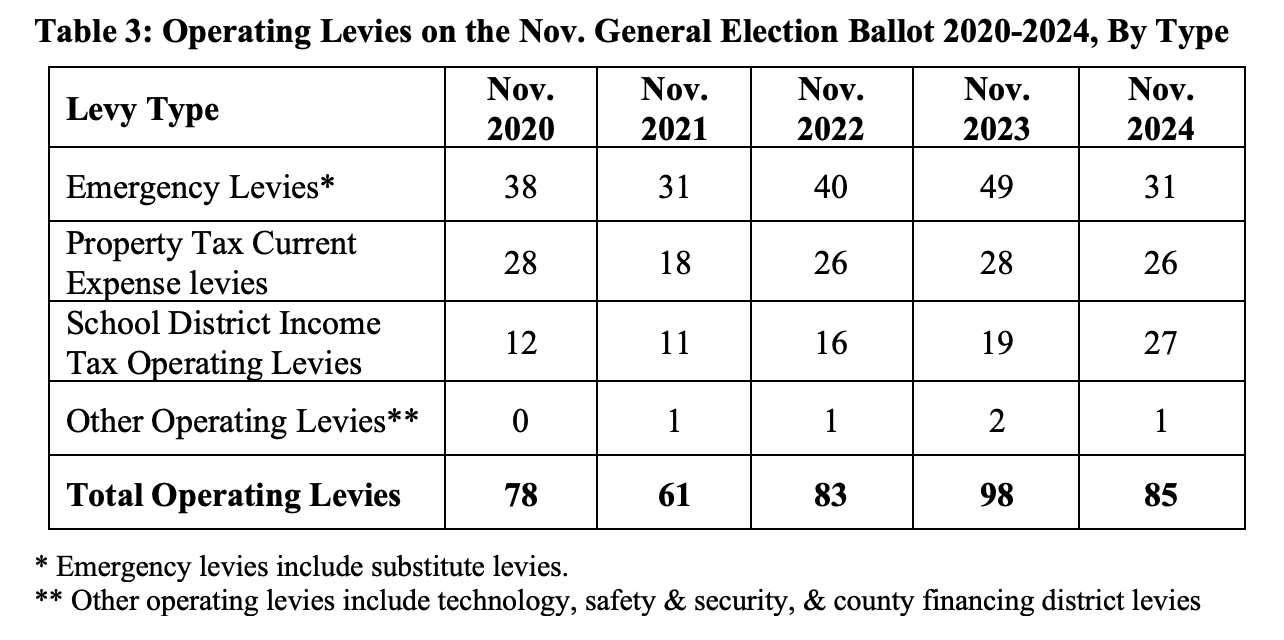

Table 3 provides a more detailed breakdown of operating levies on the November ballot from 2020-2024. The data in Table 3 show that the 85 operating levies on the ballot this year is comparable to the number on the ballot in November 2020, 2022, and 2023, with the 61 operating levies on the ballot in November 2021 being unusually low. The average number of operating levies on the November general election ballot from 2003-2024 is 109. Table 3 also shows that from 2020-2023 emergency levies typically accounted for roughly one half of school operating levies on the general election ballot in Ohio. However, in 2024 emergency levies comprise only 36% of operating levies on the ballot. Among the other types of operating levies, there are typically far more property tax current expense levies on the ballot as compared to school district income tax operating levies, however, that is not the case this November. “Other” operating levies (defined as those for county financing districts, technology levies and school safety & security levies) typically comprise only a very small share of operating levies on the ballot in recent general elections.

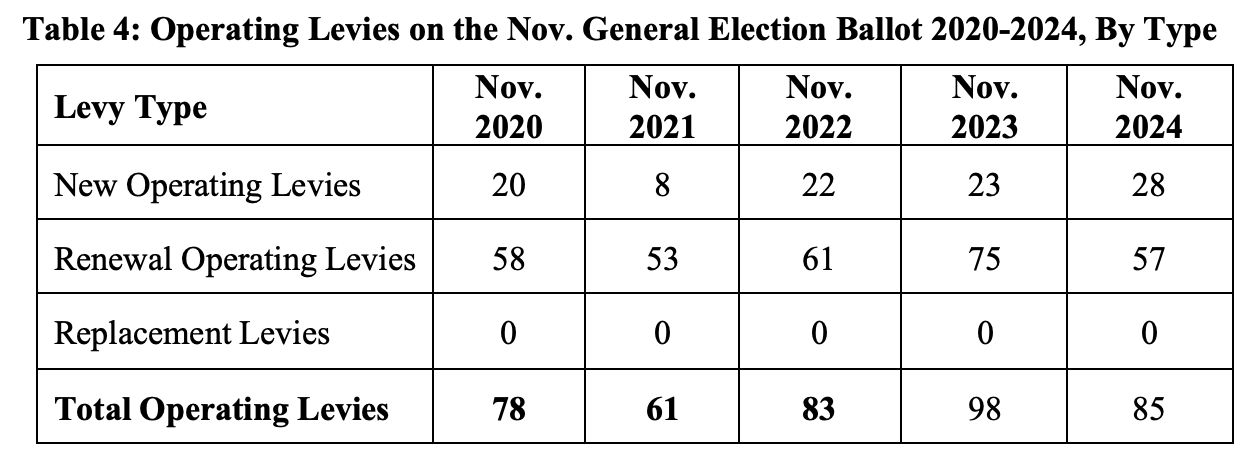

Table 4 provides additional insight on the operating levies on the November ballot in Ohio by providing a breakdown between new levies, renewal levies, and replacement levies. New levies are defined as those that are placing new millage on the ballot, renewal levies are renewing existing term-limited levies and replacement levies (which are rarely used) restore a levy to its originally voted millage level after it has been reduced by the impact of HB 920 rolling back the voted rate.

Table 4 shows that 28 (33%) of the 85 operating levies on the ballot this November are new levies. This percentage is 10 percentage points above the 23% (73 of 320) of operating levies on the ballot in the November general elections from 2020 to 2023 that were new levies. The percentage of school levies on the ballot that have been renewals has been steadily increasing in Ohio over the past 25 years as the percentage of new levies has fallen. From 1994-1997 78% of school operating levies were new levies. This percentage decreased to 61% from 1998-2006, to 54% from 2007-2013, and to only 31% from 2014-2023. While renewal levies are far more successful at the ballot (renewal levies typically pass 90% of the time while new levies have passed at roughly a 40% rate in recent years), renewal levies typically do not bring in additional tax dollars whereas new levies do.

Based on these past trends, it is reasonable to expect that the majority of operating levies on the ballot will pass this November because 2/3rd of the levies on the ballot are renewals.