On December 3, 2020 the Ohio House of Representatives passed House Bill (HB) 305 the Cupp-Patterson “Ohio Fair School Funding Plan”) by a vote of 87-9. The passage of HB 305 was the culmination of three years of work by the Cupp-Patterson work group comprised of selected legislators, superintendents, and treasurers. The work group’s initial funding proposal was introduced in March 2019 as part of the FY20-21 budget deliberations. While it was not included in the HB 166, the FY20-21 state budget, a modified version of the initial funding plan was introduced in HB 305 as stand-alone legislation in July 2019. HB 305 was then further modified before its passage by the House in December 2020.

This newsletter article provides an overview of the main components of HB 305 and a brief discussion of why it is believed to meet the criteria for constitutionality established in the March 1997 DeRolph I ruling by the Ohio Supreme Court. Much of this article is adapted from testimony on HB 305 to the House Finance Committee delivered by OEPI Research Consultant Dr. Howard Fleeter on December 2, 2020. This testimony can be found at: https://search-prod.lis.state.oh.us/cm_pub_api/api/unwrap/chamber/133rd_ga/ready_for_publication/committee_docs/cmte_h_finance_1/testimony/cmte_h_finance_1_2020-12-02-1000_1696/howardfleeter.pdf

A Brief Review of the Last Decade of Ohio School Funding

The FY10-11 school year was the last year in which Ohio had a school funding formula (the Ohio Evidence Based Model or “OEBM”) which was based on objective methodologies for determining the cost of providing an adequate education to Ohio’s 1.6 million public school students. In FY12 and FY13, Ohio employed the “Bridge Formula” which was not really a formula at all, instead basing funding on FY11 levels.

From FY14 through FY19, Ohio did have a school funding formula; however, this formula suffered from several significant deficiencies.

- First, the base cost was not based on any adequacy methodology, instead just utilizing per pupil amounts selected by the legislature. This approach is the very embodiment of “residual budgeting” which was explicitly ruled unconstitutional in the March 1997 DeRolph I ruling.

- Second, the adequacy of the FY14-FY19 funding formula was also undermined by the use of per pupil amounts for the funding of the education of students with disabilities, economically disadvantaged students, career technical education students, English learners and gifted students. Over time, these per pupil amounts became increasingly disconnected from any cost methodology that may have at one point informed them.

- Third, the State Share Index (SSI), which was the method used to determine the state and local share of funding in each of Ohio’s more than 600 school districts from FY14-FY19, suffered from multiple problems and was widely derided across the state. Because the state/local share mechanism (along with Targeted Assistance) is the principal driver of equity in the state funding formula, the FY14-FY19 funding formula was both inadequate and inequitable.

Furthermore, as problematic as the above three points are, perhaps the most serious indictment of Ohio’s FY14-FY19 funding formula was the fact that in FY19, only 113 (18.5%) of Ohio’s K-12 school districts were on the formula, with 334 on the transitional aid guarantee and 163 having their state aid limited by the Gain Cap. This problem has only been made worse in the past two years as the FY20 and FY21 state aid formulas have been frozen at FY19 levels.

Finally, the “deduction” method used to fund Ohio’s community schools along with the EdChoice, Jon Peterson (for students with disabilities), and Autism voucher programs has also significantly undermined the adequacy and equity of school funding in Ohio by effectively deducting a “local share” of funding because the deduction amount is greater than the state aid provided when these students are counted in a district’s Formula ADM. This problem has also been made worse in the current FY20-FY21 biennium because the freezing of the funding formula at FY19 levels while the community school and voucher deductions have been allowed to increase now means that all funding for new community school and voucher students the past two years has effectively come from local revenue. Ohio is currently one of the only states in the country to not fund community schools and vouchers directly by the state.

A Brief Discussion of DeRolph

The initial DeRolph decision clearly articulated that in order to be adequate, the state must utilize objective cost-based methodologies for determining the cost of educating a typical student (usually referred to in Ohio as the “base cost”). The DeRolph I ruling also recognized that a second aspect of adequacy is reflected in the additional costs above and beyond what is needed for a typical student. Examples of these additional costs are for students with disabilities, English language learners, economically disadvantaged students and career technical education students. (Ohio often refers to these funding components as “categoricals.”)

The DeRolph I ruling also explicitly stated that the state system of school funding must not be “overly reliant on local property taxes.” While this wording has been interpreted in several different ways, the most logical in the context of the evidence presented to the court and discussed at length in the DeRolph decision is that this was the equity component of the ruling and that overreliance on local property taxes is important because it creates inequities in educational opportunities between students in wealthier and poorer school districts.

By explicitly detailing the two principles of adequacy and equity described above, the DeRolph decision provided a road map for Ohio policymakers to construct a funding formula that would comply with the Ohio Constitution’s mandate to provide a “thorough and efficient” education to Ohio’s public school students. However, in many fundamentally important ways, Ohio’s current funding formula now exhibits many of the same deficiencies as did the formula in place at the time of the DeRolph decision.

Main Components of HB 305 Addressing Adequacy

In order to be adequate, the state must use objective cost-based methodologies to determine the cost of educating a typical student—the based cost. Another aspect of adequacy is recognizing the additional costs above and beyond the base cost to meet the unique needs of each student—the categoricals.

The HB 305, the Fair School Funding Plan, has the following main components which address adequacy:

- A new input-based methodology for determining the base cost amount (which will vary based on district demographics). The base cost amount can be thought of as the cost to educate the typical student in the typical district. According to the Ohio Legislative Service Commission (LSC) Fiscal Note on HB 305, the statewide average base cost would be $7,199 per pupil if HB 305 were fully implemented in FY21. As discussed immediately above, Ohio’s state aid formula has not employed an objective methodology for determining the base cost since FY11.

- The input-based methodology for the base cost calculation also implies that the HB 305 school funding plan will provide funding to Ohio’s school districts based on their enrollment as opposed to their Formula ADM (Formula ADM, which has been in use for over 20 years, also included community school and some voucher students). This means that community schools and EdChoice, Jon Peterson, and Autism voucher students will be funded directly by the state and the funding deductions from state aid for these students will no longer be employed.

- A 72.5% increase in funding for economically disadvantaged students is included in HB 305. This funding will not be subject to the phase-in and would be funded before any other component of the formula. This component of HB 305 addresses a glaring need as OEPI research has shown that funding for economically disadvantaged students in Ohio over the past 20 years has increased by 22.3% while the number of economically disadvantaged students has increased by 61.0% over the same time span.

- HB 305 also includes a directive and funding for three cost studies to be undertaken over the next two years to determine adequate funding levels for:

1. Students with disabilities – this study will review and update the special education weights that were last updated in 2007.

2. The additional cost of educating economically disadvantaged students – not previously studied in Ohio. Note that the increase in funding for economically disadvantaged students already included in HB 305 (see above) is to be considered a down payment on the additional funding expected to be recommended by the study.

3. English learners (EL) – the additional cost of educating English learners has not previously been studied in Ohio. (Note: at the time this newsletter article was written, funding for these studies as well as several others had been placed into the Senate Bill 310 – the Capital Appropriations Bill.)

- Changes and improvements to Ohio’s transportation funding formula are included in HB 305.

The above aspects of HB 305 work together to ensure that Ohio’s school funding formula will adequately fund not just the typical student, but also students with additional educational needs. Transportation is also an aspect of adequacy as school districts cannot control their geography and density, both of which significantly impact transportation costs.

Additional components of HB 305 Addressing Equity:

- A new method for determining the state and local share of funding based on a sliding scale including both income and property capacity. This new measure takes into account the size of the local property tax base and the ability of district residents to raise local tax revenue, while avoiding the deficiencies of the State Share Index which was in place in Ohio’s school funding formula from FY14-FY19.

- Continued funding of Targeted Assistance and Capacity Aid. These two components of the funding formula provide additional funding to lower wealth school districts to allow them to pursue local educational initiatives in the same manner that wealthier school districts are able. Equity (and reduced reliance on local property taxes) is enhanced by funding components like this that allow less wealthy districts the ability to provide educational services that “go beyond the formula” similar to that in wealthier districts.

The improved state and local share calculation and the retention of Targeted Assistance and Capacity Aid are the two biggest drivers of the equity of the school funding formula.

More information on details of HB 305 can be found in the LSC HB 305 “As Passed By House” Bill Analysis at: https://www.legislature.ohio.gov/download?key=14992&format=pdf

LSC Typology Group Analysis of HB 305

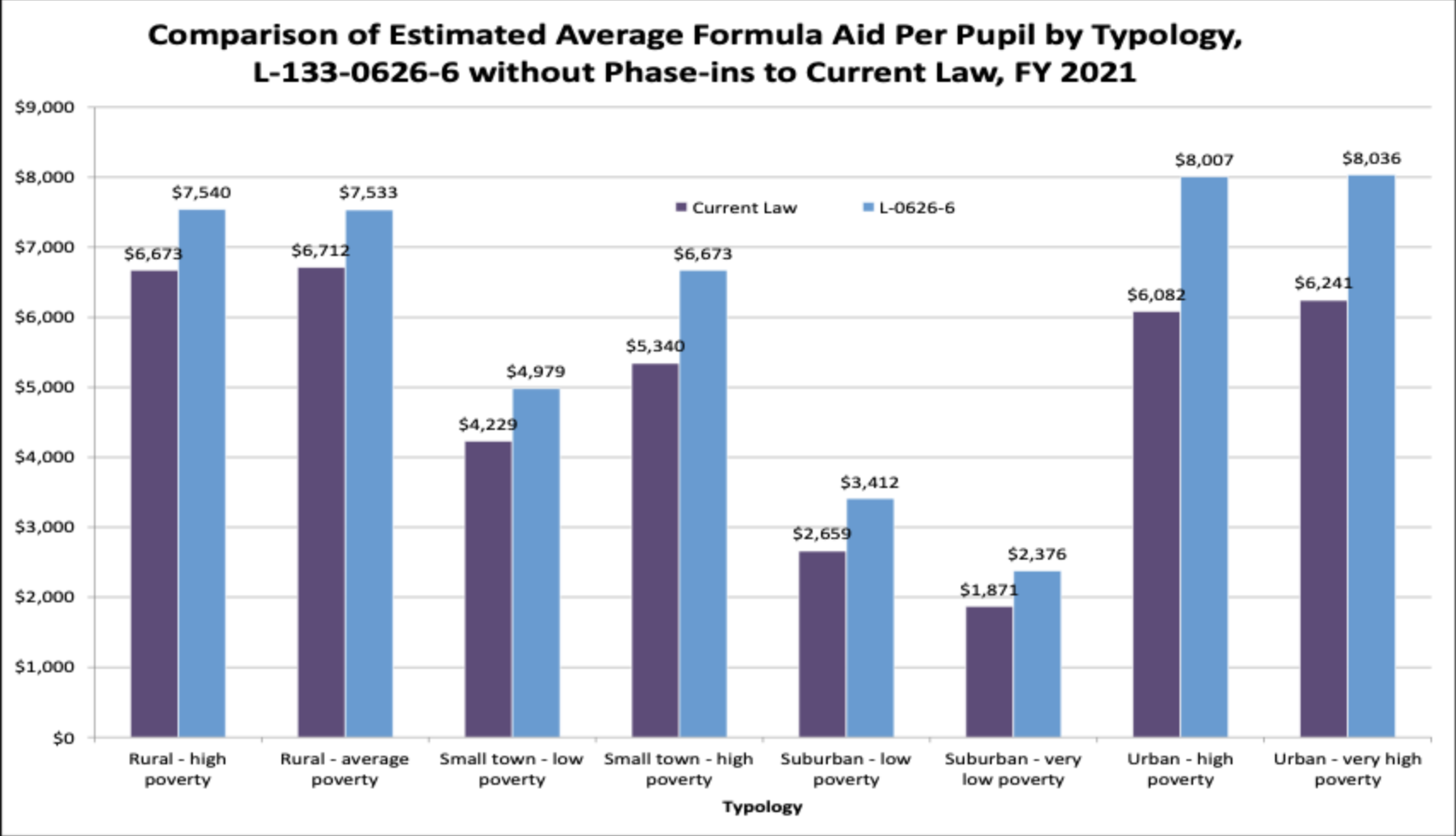

The chart below compares per pupil funding in the version of H.B. 305 passed by the House (referred to in the chart as “L-133-626-6”) with FY21 current law FY21 per pupil funding by ODE typology group. The chart shows that average per pupil funding is higher under HB 305 than under current law for every typology group. The graph also shows that average increases in funding under HB 305 also tend to be larger for districts in less wealthy typologies than in wealthier typologies. This chart demonstrates the improvement in funding equity to be expected under HB 305.

Source: LSC